We all know that insurance policies issued by the Life Insurance Corporation (LIC) are acknowledged as the best ones as compared to other related insurer.

The amalgamation of LIC's dedication and sturdy work commitment is one of the reasons for its success stories. Although buying any of the LIC's policies will certainly be a wise decision for any investor, but choosing the best one as per your requirement can be tedious at times. Here comes the role of an insurance agent! Opting for the service of a life insurance advising agency is extremely easy, which will indeed streamline your investment decisions.

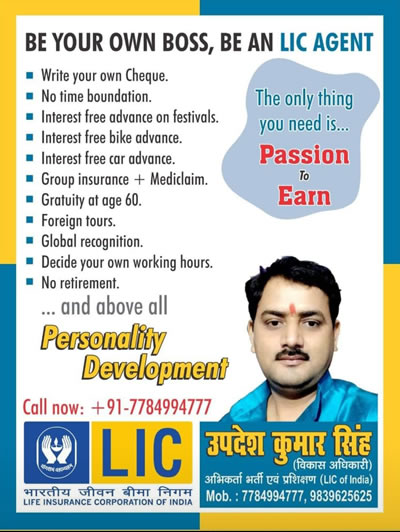

They are also known as LIC agents, who can provide the investor with various insurance plans as per his or her financial requirements and fund availability. Be it buying an LIC policy for you, your children or friends, a well knowledgeable LIC agent recommends you the most suitable policy as per your income.

That's not all! he or she also advises you about the latest and upcoming policies that may be useful in the future. Moreover, in order to avoid payment or policy related woes, you need to make sure that your insurance agent is a registered LIC agent.

If we talk about the payment/policy's premium reminder, insurance agents play a vital role here as well. There may be cases wherein you own more than one insurance policy that have varied due/maturity dates.